Cat and dog food are the most popular items in pet shops, whether dry or wet. The Petfood Index compares the prices of pet food from the largest online shops, including Zooplus, Fressnapf and ZooRoyal, every day, with up to 900,000 prices recorded each month. Around 220 brands are currently represented, and products with fewer than three offers per day are excluded from the listings.

As founder Olaf Oczkos explains in an interview with PET worldwide, this provides an exciting insight into market developments and fundamental support for the entire pet food industry.

What exactly is the Petfood Index?

It provides real-time brand transparency. This allows us to address the three key issues currently affecting the pet food industry. If the food is too expensive, sales suffer; if it is sold too cheaply, margins are reduced; and if it is out of stock, neither sales nor margins are optimal.

The report has been created to remedy these three issues in the pet food sector.

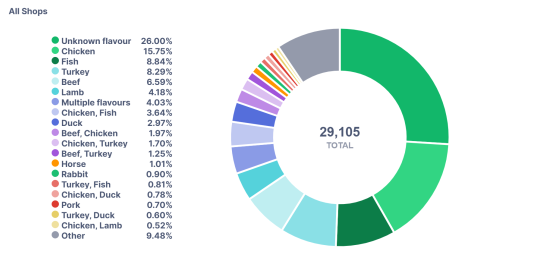

Every month, the Petfood Index categorises 900,000 prices by brand, date, category, life stage, flavour and size, enabling individual products to be compared. It is a strategic tool that allows users to identify their competitive segments. It answers questions such as: who has listed the product at what price; where are reorders necessary; where are discount campaigns currently running; and how are they affecting sales? Questions like these can be answered with ease.

What analyses and market assessments can be carried out?

We evaluate the data in five different reports. Based on the offer list, brands can be compared with their main competitors. The offer list includes all current product offers, including the sales price, flavour, and category. The Market Report shows how the product is performing in the market. It shows how they are performing: are customers put off by the pricing? Is a particular flavour doing particularly well? Has a reorder been missed? Are there any outliers in the sales curve? If so, this indicates that you need to take a closer look at why. The Product Report highlights details of the product range and reveals its positioning and changes. Is one product dominating, or is it worth offering a variety if one type of meat is not in high demand? This analysis can inform strategic decisions about where to invest. The Revenue Report monitors relevant brands, and the sales report makes categories, package sizes and much more comparable. The Competition Report enables strategic and precise pricing decisions: It provides a real-time overview of brands’ positions.

What target group does the Petfood Index address?

The report is designed to give international customers an overview of the market. We estimate that our target audience comprises around 1,000 pet food brand manufacturers in Europe. Around a third of these are based in Germany, a country that forms a clear focus of our monitoring.

The report is an essential tool for decision-makers in sales, marketing and product management. As well as supporting the industry, it can also help retailers to become more competitive. The information is also valuable for start-ups who may have to compete with three products in an environment of 300. In principle, the Petfood Index is for anyone who wants to make more informed operational and strategic pricing decisions with minimal effort by comparing prices clearly and easily.

Petfood Index

A complete package of a certain scope is always booked. Further information about the report, options and offers is available in a personal consultatio.

There are three packages:

1. 30-day trial subscription

2. Annual subscription

3. Annual Enterprise subscription (including customisation,

extended monitoring, optional modules and analysis options).

All packages include:

- Price reports for pet food

- Over 900,000 dog and cat food prices updated daily

- From online shops: Fressnapf, Zooplus and Zooroyal.

- 220+ pet food brands

- Dry and wet food

- 14 varieties (fish, chicken, beef, etc.).

- Data download

- Five ready-to-use core reports

Interested?

Book your personal, no-obligation presentation now:

Menü

Menü

Newsletter

Newsletter