All signs point to expansion for pet food manufacturer Seitz. In the past financial year, the group can look back on sales growth of 3.8 per cent compared with the previous year to around 58 million euros. Exports currently account for six per cent of the group’s turnover, which has grown by a strong 150 per cent. The Fleischeslust brand, which was acquired almost five years ago, also grew by six per cent, but is set to expand by 9.2 per cent in the current year.

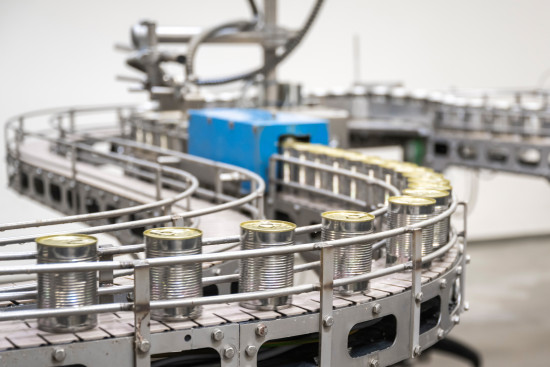

The private label business accounts for a good 75 per cent of Seitz’s turnover. Managing director Max Graf Kerssenbrock describes it as “one of our success factors in turbulent times”. 85 per cent of the production volume is supplied in tins, followed by sausage and barf products.

No expansion is possible without investment, however. The production facilities are constantly being modernised and upgraded to guarantee quality requirements. After investing in packaging solutions at the Kirchlinteln site last year, investments in quality are on the agenda this year with the optimisation of incoming goods inspection and a reorientation of meat processing. In addition, the construction of a new deep-freeze warehouse has ensured the availability of raw materials and thus the ability to produce and deliver. “We have been repeatedly praised as unique in the market for our consistently reliable availability of goods in recent years, regardless of the pandemic or disrupted supply chains,” reports Kerssenbrock.

The meat thing

Kerssenbrock also considers the question of “How much meat does an animal need?” to be an important issue at Seitz. He is certain that dogs do not need the high meat content of 90 to 100 per cent that has been communicated in the past. “It’s all about the right nutritional values, which can also be achieved excellently with alternative proteins,” emphasises the industry professional. He adds: “As much meat as possible was an industry-wide fallacy.”

Seitz considers the range of vegetarian alternatives on the pet food market to be unattractive, however, particularly in terms of important sensory characteristics such as appearance, feel and smell. To counteract this, Seitz has invested heavily in the development of vegetarian products in recent months. These should “stand out clearly from the previous range in terms of quality and at comparable prices”, says Kerssenbrock. In the private label segment in particular, Seitz wants to enrich the market with products that “meet the highest sensory standards, are almost indistinguishable from products for human consumption and thus sustainably increase the acceptance of meat-reduced or meat-free complete feeds for both humans and animals”. To this end, the product development team was increased to six people last year. This also made it possible to shorten the lead times for new developments without losing sight of the development of innovations for the market.

At Interzoo, various meat-free or meat-reduced complete feed concepts will now be offered in tins. Insect proteins are also part of the innovation programme, although Kerssenbrock is sceptical as to whether this trend will catch on in Europe: “Dog owners must be able to identify with the product.”

Gently cooked instead of barf

Seitz also takes a critical view of the development of the barf segment. Offering raw meat entails risks in terms of handling and frozen food chains, which are increasingly coming to the attention of health authorities. “Gently cooked products are therefore already a big topic, particularly in the USA and the UK, and could soon at least usefully complement classic barf here too,” reports Kerssenbrock.

These are gently cooked, pasteurised products that represent a middle ground between canned and barf and are offered in chilled or frozen form. At Interzoo, Seitz will also be focusing on a Gently Cooked concept, which will initially be offered exclusively as a private label.

Keyword Fleischeslust

“We believe in sausage,” states Kerssenbrock. With the Fleischeslust brand, the company is the market leader in the wet food segment in sausage form and assigns this packaging form a high strategic relevance in the Seitz Group.

The D2C online shop was completely relaunched in mid-2023, since when its share of total Fleischeslust sales has grown to over ten per cent. Sustainability is also an important aspect of the sausage packaging form, as it produces significantly less waste than a can. In close cooperation with the packaging suppliers, Fleischeslust has developed an aluminium-free casing that will be introduced in the second half of 2024. When asked about alternatives to meat, Kerssenbrock describes Fleischeslust customers as a very meat-orientated target group. The company has therefore decided to cautiously introduce the topic of sustainability to the range. In the Meat & Treat range, the meat content has been reduced to 60-70 per cent – depending on the variety – and this step has been very well received by shoppers in Germany and abroad. The aluminium-free casing in the Classic range will be a second step.

In the current year, Kerssenbrock is focusing on strengthening the company’s position in the specialist trade and expanding brand awareness with a new emotional communication campaign, which will be visible for the first time at Interzoo. On the product side, optimisation of the complete food menus and the launch of new varieties are on the agenda, particularly in the Lifestage (for junior/senior) and Sensitive ranges. And new treat products will be launched at the end of the year. “We are also working on a new cat concept for the coming years,” concludes Kerssenbrock.

Menü

Menü

2/2024

2/2024

Newsletter

Newsletter