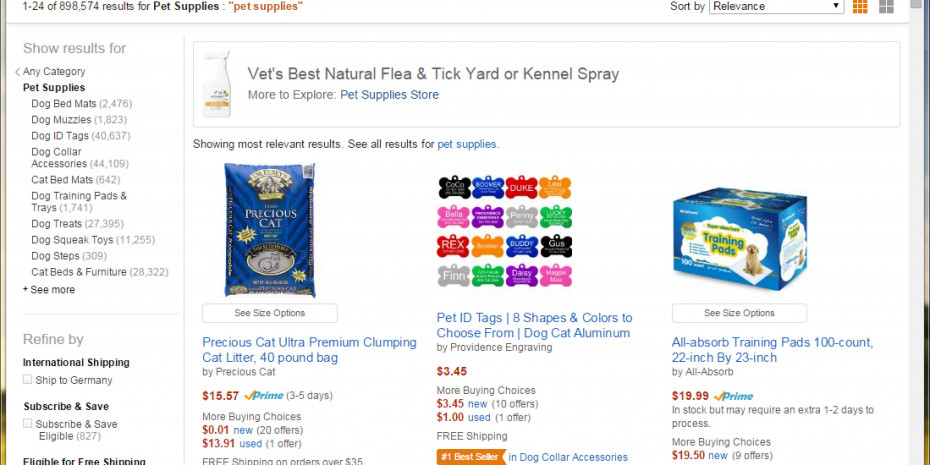

In figures, this equates to a volume of sales of around $ 2 bn at retail. Packaged Facts doesn't see the success of online retailing tailing off in the next few years. "Internet sales of pet products are projected to grow between 10 per cent and 15 per cent annually through 2018, substantially outpacing projections for overall pet product retail sales growth," is the market research publisher's headline to its latest report "Pet Product Retailing in the US: Channel Competition and Consumer Shopping Trends, 2nd Edition".

Internet on the rise

The growing market share of online trading is also due to the fact that more and more retailers are turning to the Internet as a sales medium beyond bricks-and-mortar. Packaged Facts considers that the Internet is especially well suited to "info-centric" pet products. These include premium and niche items, for instance, offering many opportunities to communicate detailed product information via websites, email, chat groups, blogs, social networking and online advertising.

According to a consumer survey by Packaged Facts, 41 per cent of pet product buyers use the Internet to find information about pet care services and 39 per cent to help choose which pet foods to buy. More than 5 million dog or cat owners use the Internet to purchase pet products, estimates Packaged Facts.

Petissimo and Fressnapf among the Top online retailers

Petissimo and Fressnapf made it into the Top 12 companies of FMCG retailers.This year 12 companies made it on to the list of …

Smaller chain formats

The bricks-and-mortar trade is aware of the growing competition from the Internet. The two leading pet store chains, PetSmart and Petco, have thus begun to test smaller store formats, which with an average retail area of between 450 and 550 m2 are roughly half the size of the average store. While Petco already operates over 100 of these stores, PetSmart so far has around 20 stores with a smaller retail area. The two speciality chains can operate more flexibly in the market with a smaller format and also occupy sites that would not be viable for a larger store. However, this could also be a reaction to the growing competition in the pet product trade. The supermarket giant Wal-Mart in particular, but also dollar stores and discounters are making life tough for the big pet store chains with their aggressive price offers. And a survey by Packaged Facts has shown that US pet owners are on the look-out for good deals. In…

Menü

Menü

3/2015

3/2015

Newsletter

Newsletter