2024 was also a challenging year for Italy, with persistent inflation and economic uncertainty resulting from higher energy and raw material costs, as well as a general slowdown in growth. Nevertheless, the Italian dog and cat food market achieved sales of over 3.1 bn euros, with total sales reaching 666 504 tonnes.

The segment continued to grow, albeit at a significantly slower pace than in the previous year. The price increase that characterised 2023 slowed down, with the value of sales rising more moderately (3.7 per cent) while volumes declined slightly, levelling off again at the 2021 level.

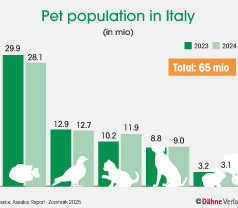

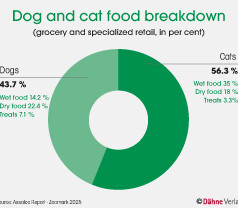

Large retail chains and pet shops recorded double-digit growth in the dog and cat food market: wet food for dogs (10.5 per cent) and cats (14.1 per cent) led the way, followed by dry food for dogs (8.6 per cent) and even better results for cats (9.7 per cent). These results reflect the growing popularity of cats as pets.

Overall, the market accounted for 3 125 mio tonnes, which was an increase of 3.7 per cent compared to the previous year.

Compared to the overall pet food market, the wet food segment remains the most significant, accounting for 49 per cent of the market and recording value growth of 4.3 per cent. Dry food follows with a market share of 40.4 per cent and value growth of 13.4 per cent.

Overall, the market for functional snacks and treats for dogs and cats continues to show positive trends, but only in terms of value (+4.2 per cent). The cat segment, however, recorded double-digit growth in both value (+11.5 per cent) and volume (+0.2 per cent).

In particular, the snack market continued to develop positively, with significant value growth recorded in the cat segment in food retail (10.9 per cent) and large retail chains and pet shops (11.3 per cent), while sales in traditional pet shops were lower at 3.7 per cent.

Online sales of dog and cat food are also booming: the total value in Italy in 2024 was 451 mio euros, corresponding to growth of 8.2 per cent compared to the previous year. As in brick-and-mortar retail, the cat segment was the growth driver here too.

Demographic change

An important reason for the increase in pet food sales is closely…

Menü

Menü

03

03

Newsletter

Newsletter