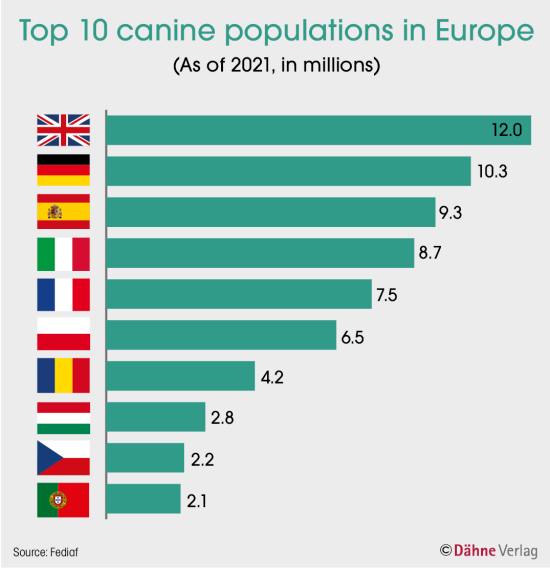

The coronavirus pandemic was a significant factor behind the massive increase in the number of dogs kept in European households. In Europe alone, the canine population came to nearly 93 million (source: Fediaf) last year. Of this number, almost 73 million resided in 25 per cent of households in EU member countries.

Many retailers speak of a new class of customers in their stores in relation to the increase in the dog population. They are well informed, mostly via social media; they know exactly what they want and are quite happy to invest in quality dog food in the long term.

A major beneficiary of this trend are treat products, which have seen double-digit percentage growth in most countries. There’s an obvious reason for this. “Treats are the expression of a habit of spoiling dogs that makes life easier for owners while increasing their pet’s loyalty to them,” says Seitz managing director Max Graf Kerssenbrock with regard to this phenomenon.

Meat and insects

The proportion of fresh meat is a key consideration when it comes to dog food. Many manufacturers report strong interest from retailers as soon as it is mentioned in the listing discussion that only fresh meat is used. It is stressed in the same breath, however, that the tight situation in the raw materials markets is making it necessary to look increasingly for alternative sources of protein to replace animal proteins.

Alternative protein sources, especially insects, are not well received by all shoppers and pets, however, and in consequence several manufacturers are holding back because there are no reliable long-term studies available as yet. One manufacturer went as far as to tell PET worldwide that “not a single business contact missed this protein source in our assortment at the last Interzoo.” For German manufacturer Mera, other sources of protein such as mung beans are even expected to be added alongside insect products in the near future.

Difficulties in procuring raw ingredients are being felt across the sector, ultimately resulting in price rises. It is reported that much more time is being spent on comparisons and market analyses for procurement, because established suppliers are no longer able to deliver in some cases. Obtaining ingredients from regional suppliers appears to be a little easier, as smaller producers above all are saying. For consumers in particular, regional origin and sustainability…

Menü

Menü

3/2022

3/2022

Newsletter

Newsletter